A meeting of the Manatee County Port Authority will be held Thursday, August 19, 2021, at 9:00 am, or as soon thereafter as is practicable in the third-floor meeting room of the Port Manatee Intermodal Center, 1905 Intermodal Circle, Palmetto, FL 34221, located at the intersection of South Dock Street and Reeder Road at Port Manatee.

Anyone wishing to attend this meeting who does not have an appropriate Port Manatee identification badge may enter Port Manatee by the north or south gate by displaying photo identification, generally a driver’s license.

MANATEE COUNTY PORT AUTHORITY AGENDA

August 19, 2021 – 9:00 am

The Manatee County Port Authority may take action on any matter during this meeting, including those items set forth within this agenda. The chairperson, at the option of the chairperson, may take business out of order if the chairperson determines that such a change in the agenda’s schedule will expedite the business of the Port Authority.

CALL TO ORDER

Invocation – Rev. Allen Howe Pledge of Allegiance Audience Introductions Public Comments

Presentation – Captain Matthew Thompson – U.S. Coast Guard

Consent Agenda

Del Monte Fresh Produce Lease Renewal and Warehouse 6 Amendment

2022 Legislative Priorities

Resolution for the Fiscal Year 2021-2022 Manatee County Port Authority Budget Public Comments

FDOT Comments

Executive Director Comments Commissioner Comments

According to Section 286.0105, Florida Statutes, any person desiring to appeal any decision made by the Port Authority with respect to any matter considered at this meeting will need a record of the proceedings, and for such purpose may need to ensure that a verbatim record of the proceedings is made, which includes the testimony and evidence upon which the appeal is to be based.

Reggie Bellamy, Chairman

Misty Servia, 1st Vice-Chairman; James Satcher, 2nd Vice-

Chairman; Carol Whitmore, 3rd Vice-Chairman;

Vanessa Baugh, Member; George Kruse, Member;

Kevin Van Ostenbridge, Member

August 19, 2021

AGENDA ITEM 1.: PRESENTATION – CAPTAIN MATTHEW

THOMPSON, U.S. COAST GUARD

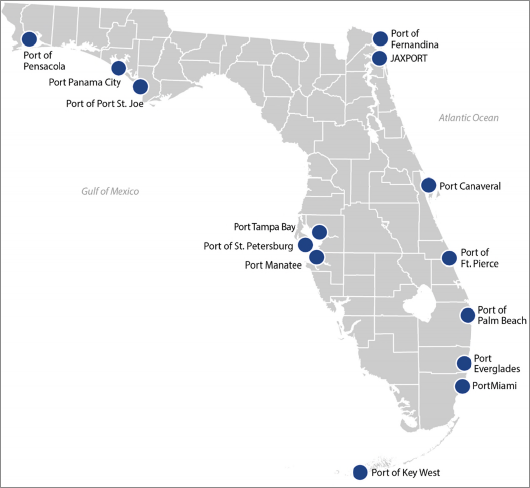

Captain Matthew Thompson, Commander, U.S. Coast Guard Sector St. Petersburg, serves as Captain of the Port, Officer in Charge of Marine Inspection, Search and Rescue Mission Coordinator, Federal On- Scene Coordinator while directing Coast Guard operations along the West Coast of Florida and throughout the Tampa Bay region. Sector St. Petersburg is comprised of 2,700 Active Duty, Reserve, Civilian, and Auxiliary personnel, as well as 12 multi-mission units, including five boat stations, six cutters, and an Aids to Navigation Team.

Previously, Captain Thompson was assigned to the Coast Guard Personnel Service Center, Officer

Personnel Management Division (opm-1) as Chief of Boards, Panels, Promotions, and Separations Branch. There he directed and oversaw all active duty officer promotion boards and advanced education panels, and effected all officer promotions, retirements and separations for the nearly 8,500 member commissioned and warrant officer corps.

Captain Thompson’s operational assignments include Response Department Head at Coast Guard Sector San Francisco, five afloat tours as an officer and enlisted Quartermaster, and as Command Center Senior Controller at Sector San Juan, Puerto Rico. His afloat assignments include Commanding Officer of USCGC SAPELO, Executive Officer of USCGC NUNIVAK, Operations Officer of USCGC ACACIA and crewmember onboard USCGCs ATTU and OCRACOKE as an enlisted member.

He also served in staff assignments as Chief of External Affairs at the Coast Guard Eleventh District, where he oversaw and coordinated the congressional, governmental and international engagement programs, as well as on the Coast Guard Pacific Area staff as the program manager for the Maritime Law Enforcement (MLE) and Ports Waterways and Coastal Security (PWCS) missions.

Captain Thompson holds a Bachelor of Science from Excelsior College in Management, and a Joint Professional Military Education certification through the U.S. Air Force, Air Command and Staff College. He is a permanent Cutterman and holds the Advanced Boat Forces Insignia. His personal awards include three Meritorious Service Medals, four Commendation Medals, and three Achievement Medals.

He is married to Lynesh Thompson, of San Juan Puerto Rico, and they have three children.

August 19, 2021

CONSENT AGENDA

Warrant List

Minutes July 28, 2021

Budget Resolution

Public Transportation Grant Agreement – Master Plan

Public Transportation Grant Agreement – Dry/Chill Warehouse

Public Transportation Amendment to the Public Transportation Grant Agreement – Intermodal Container Yard

Anchor House Lease Amendment Two

Coronavirus State Fiscal Recovery Funds Subrecipient Grant Agreement

Approval of the Sublease between Carver Maritime LLC and Apex Engineered Products

Cargo Pad Construction/Storage Agreement and Lease Amendment Four

RECOMMENDATION:

Move to approve the Consent Agenda incorporating the language as stated in the recommended motions on the cover sheets for the Consent Agenda items.

XXXXXXX | V103830 | AERIAL INNOVATIONS INC. | 128.00 | |

AP | XXXXXXX | V025267 | ALLEGRA PRINTING OF BRADENTON | 213.22 |

AP | XXXXXXX | V023321 | AMERICAN EXPRESS TRAVEL RELATE | 83.04 |

AP | XXXXXXX | V113719 | APEX OFFICE PRODUCTS INC | 212.99 |

AP | XXXXXXX | V118009 | AT AND T | 71.33 |

AP | XXXXXXX | V013140 | AT AND T MOBILITY | 50.98 |

AP | XXXXXXX | V023501 | AT AND T TELECONFERENCE SERVIC | 42.47 |

WT | XXXXXXX | V019189 | BANK OF AMERICA | 10,638.85 |

AP | XXXXXXX | V002730 | BANK OF AMERICA | 1,000.04 |

AP | XXXXXXX | V007624 | BRIGHT HOUSE | 1,053.73 |

AP | XXXXXXX | V009839 | BRYANT MILLER AND OLIVE PA | 24,607.76 |

AP | XXXXXXX | P000278 | BUQUERAS, CARLOS | 152.99 |

AP | XXXXXXX | P000380 | BURGER, STEPHEN T | 61.75 |

AP | XXXXXXX | V021377 | CINTAS CORPORATION | 299.58 |

ZP | XXXXXXX | L245170 | COSTANTINO BODY SHOP INC | 2,544.60 |

AP | XXXXXXX | V027465 | CRISDEL GROUP INC | 983,497.81 |

AP | XXXXXXX | V010160 | CURLIN INC | 245.59 |

AP | XXXXXXX | V006291 | DEX IMAGING INC | 290.17 |

AP | XXXXXXX | V282890 | DISCOUNT LOCK AND KEY INC | 10.00 |

AP | XXXXXXX | V024683 | EVERGLADES EQUIPMENT GROUP | 231.61 |

AP | XXXXXXX | V028484 | EXTREME STEAM CLEANING SERVICE | 450.00 |

AP | XXXXXXX | V323190 | FASTENAL COMPANY | 158.70 |

AP | XXXXXXX | V324212 | FEDERAL EXPRESS CORPORATION | 44.48 |

ZP | XXXXXXX | L333009 | FLEET PRODUCTS | 57.60 |

ZP | XXXXXXX | L333009 | FLEET PRODUCTS | 76.78 |

AP | XXXXXXX | V007961 | FLORIDA INDUSTRIAL SCALE COMPA | 452.00 |

AP | XXXXXXX | V019619 | FLORIDA POWER AND LIGHT COMPAN | 64,761.43 |

AP | XXXXXXX | V019619 | FLORIDA POWER AND LIGHT COMPAN | 10,320.22 |

AP | XXXXXXX | V019619 | FLORIDA POWER AND LIGHT COMPAN | 18,638.47 |

AP | XXXXXXX | V019619 | FLORIDA POWER AND LIGHT COMPAN | 22,223.42 |

AP | XXXXXXX | V021937 | FRONTIER COMMUNICATIONS OF FLO | 2,386.79 |

AP | XXXXXXX | V021937 | FRONTIER COMMUNICATIONS OF FLO | 59.19 |

ZP | XXXXXXX | L007982 | FRONTIER LIGHTING INC | 1,279.06 |

AP | XXXXXXX | V027688 | FUEL MEISTERS | 172.00 |

AP | XXXXXXX | V020807 | GENUINE AUTOMOTIVE | 75.92 |

AP | XXXXXXX | V020807 | GENUINE AUTOMOTIVE | 239.15 |

AP | XXXXXXX | V020807 | GENUINE AUTOMOTIVE | 464.88 |

AP | XXXXXXX | V380805 | GOODYEAR TIRE & RUBBER CO. | 620.92 |

AP | XXXXXXX | V006728 | GOVCONNECTION INC | 936.81 |

AP | XXXXXXX | V385107 | GRAHAM WHITE SALES | 127.41 |

AP | XXXXXXX | V385628 | GRAINGER INC, W W | 268.79 |

AP | XXXXXXX | V385628 | GRAINGER INC, W W | -624.28 |

AP | XXXXXXX | V385628 | GRAINGER INC, W W | 632.21 |

AP | XXXXXXX | V385628 | GRAINGER INC, W W | 572.85 |

WT | XXXXXXX | V020386 | HANCOCK BANK | 29,253.12 |

AP | XXXXXXX | V013868 | HARDEN SUPPLY LLC | 698.93 |

AP | XXXXXXX | V023500 | HOME DEPOT CREDIT SERVICES | 347.05 |

AP | XXXXXXX | V023500 | HOME DEPOT CREDIT SERVICES | 1,622.05 |

AP | XXXXXXX | V017862 | ID WHOLESALER | 237.52 |

AP | XXXXXXX | P000094 | ISIMINGER, GEORGE | 180.00 |

AP | XXXXXXX | V012352 | JANI KING OF TAMPA BAY | 713.00 |

AP | XXXXXXX | V027228 | JENNI AND GUYS | 60.00 |

WT | XXXXXXX | V026038 | JOCELYN HONG AND ASSOCIATES | 5,000.00 |

AP | XXXXXXX | V493800 | JOHNSON PRINTING | 1,009.01 |

AP | XXXXXXX | V520115 | KIMBALL MIDWEST | 145.12 |

AP | XXXXXXX | V000423 | LEWIS LONGMAN AND WALKER PA | 587.50 |

AP | XXXXXXX | V018272 | LIGHT BULB DEPOT OF TAMPA | 369.90 |

AP | XXXXXXX | V023184 | LYNCH OIL COMPANY INC | 11,071.70 |

AP | XXXXXXX | V625403 | MAINTENANCE TOO PAPER CO INC | 466.19 |

AP | XXXXXXX | V627027 | MANATEE CHAMBER OF COMMERCE | 315.00 |

AP | XXXXXXX | V004140 | MANATEE COUNTY PUBLIC WORKS DE | 218.83 |

UT | XXXXXXX | V004140 | MANATEE COUNTY PUBLIC WORKS DE | 7,359.53 |

AP | XXXXXXX | V026617 | MIDCOAST CONSTRUCTION ENTERPRI | 306,903.17 |

AP | XXXXXXX | V681645 | NATIONAL RAILWAY EQUIPMENT | 211.88 |

AP | XXXXXXX | V027384 | NORTH RIVER SMALL ENGINE LLC | 220.23 |

AP | XXXXXXX | V025892 | OCEANSIDE PROMOTIONS | 485.00 |

AP | XXXXXXX | V701905 | OFFICE DEPOT INC | 1,257.99 |

AP | XXXXXXX | V026631 | PALMETTO AUTO WAREHOUSE LLC | 18.73 |

AP | XXXXXXX | V027189 | PCS CIVIL INC | 195,091.37 |

AP | XXXXXXX | V027189 | PCS CIVIL INC | 28,275.00 |

AP | XXXXXXX | V736427 | PITNEY BOWES CREDIT CORP | 141.00 |

AP | XXXXXXX | V020765 | R S AND H INC | 7,525.86 |

AP | XXXXXXX | V019469 | RAILINC CORPORATION | 260.00 |

AP | XXXXXXX | V027409 | RAMBA LAW GROUP LLC | 3,500.00 |

AP | XXXXXXX | P000343 | SANTOYO, ROXANA | 6.00 |

AP | XXXXXXX | V025907 | SHORT LINE DATA SYSTEMS INC | 400.00 |

AP | XXXXXXX | V015633 | SIEMENS INDUSTRY INC | 711.00 |

AP | XXXXXXX | V018137 | STANTEC CONSULTING SERVICES IN | 74,253.08 |

AP | XXXXXXX | V014815 | STAPLES ADVANTAGE | 1,341.82 |

WT | XXXXXXX | V874841 | STATE OF FLA DEPT OF REVENUE | 21,605.56 |

AP | XXXXXXX | V894121 | SUMMERS RAILROAD CONTRACTOR I | 190,049.99 |

AP | XXXXXXX | V023659 | SYNERGY NDS INC | 141,750.00 |

AP | XXXXXXX | V901518 | TAMPA BAY STEEL CORPORATION | 206.66 |

AP | XXXXXXX | P000397 | TILLOTSON, CHARLES D | 165.00 |

AP | XXXXXXX | V006904 | UNITED REFRIGERATION INC | 3,186.48 |

AP | XXXXXXX | V009667 | VERIZON WIRELESS | 1,502.27 |

AP | XXXXXXX | V961411 | WEST FLORIDA SUPPLY CO | 232.58 |

AP | XXXXXXX | V019987 | WIMAUMA AUTO PARTS INC | 71.81 |

AP | XXXXXXX | P000292 | ZIMMERMANN,VIRGINIA | 239.88

|

Total warrants (checks) for period reported 2,189,098.12

![]()

MANATEE COUNTY PORT AUTHORITY REGULAR MEETING

PORT MANATEE INTERMODAL CENTER, THIRD FLOOR

1905 Intermodal Circle Palmetto, Florida

JULY 28, 2021

Present were:

Reggie Bellamy, Chairman

Misty Servia, First Vice-Chairman

James A. Satcher III, Second Vice-Chairman Carol Whitmore, Third Vice-Chairman Vanessa Baugh

George W. Kruse

Kevin Van Ostenbridge (Entered during meeting)

Also present were:

Carlos Buqueras, Executive Director Jennifer R. Cowan, Port Authority Attorney Angel Colonneso, Clerk of the Circuit Court

Kim Wilder, Finance Director, Clerk of the Circuit Court Vicki Tessmer, Deputy Clerk, Clerk of the Circuit Court

Chairman Bellamy called the meeting to order at 9:00 a.m.

![]() Invocation was delivered by Reverend Allen Hower, Anchor House

Invocation was delivered by Reverend Allen Hower, Anchor House

![]() Carlos Buqueras, Executive Director, welcomed everyone back to the Port, stressed that the Port does not close due to the importance of supplying goods to citizens.

Carlos Buqueras, Executive Director, welcomed everyone back to the Port, stressed that the Port does not close due to the importance of supplying goods to citizens.

![]() Members of the Audience introduced themselves.

Members of the Audience introduced themselves.

PUBLIC COMMENTS

There being no public comment, Chairman Bellamy closed public comment.

AGENDA PA20210728DOC001

EMPLOYEE RECOGNITION

Carlos Buqueras, Executive Director, David St. Pierre, Port Security Director, recognized the following employees:

Carlos Buqueras, Executive Director, David St. Pierre, Port Security Director, recognized the following employees:Rachel Gallant, Trusted TWIC Agent – Five years of service

Mylaka Ware, Badging Clerk – Fifteen years of service (Enter Member Van Ostenbridge)

Mr. Buqueras elaborated on the significant achievements of the Security Department, including national training. PA20210728DOC002

MARINE TOWING OF TAMPA LLC

Norman Atkins, Vice President, Marine Towing of Tampa LLC, used a slide presentation to discuss the history of the company, the primary function to dock and undock vessels to ensure they move safely and in a timely manner. He provided specs on the vessels they use and noted the tugs work 24 hours a day and most have fire-fighting capabilities. Tugs cost from $8 to $10 million, and are fully equipped. He continued to explain the process for bringing the ships in to the Port. Pilots are 100 percent in control of the vessels once they

Norman Atkins, Vice President, Marine Towing of Tampa LLC, used a slide presentation to discuss the history of the company, the primary function to dock and undock vessels to ensure they move safely and in a timely manner. He provided specs on the vessels they use and noted the tugs work 24 hours a day and most have fire-fighting capabilities. Tugs cost from $8 to $10 million, and are fully equipped. He continued to explain the process for bringing the ships in to the Port. Pilots are 100 percent in control of the vessels once theyenter Egmont Channel. He responded that the weather has to be quite severe for the tugs to not operate. The majority of ships require the tugs to help them make the turn from the cut into Port Manatee.

Discussion ensued that Port Members should go out for a trip on a tug when they have a chance.

Mr. Atkins complimented Port Manatee for the increased business in the past couple of years, and stated Marine Towing values their relationship with the Port. PA20210728DOC003

TAMPA BAY PILOTS ASSOCIATION

![]() Terry Fluke, Executive Director, Tampa Bay Pilots Association, stated the channel tightens as it moves further north into Tampa Bay. He used a slide presentation to provide a history of the Pilots Association established in 1886 on Egmont Key, the channel, weather conditions, leveraging technology to navigate the channel with (Portable Pilot Units) PPU devices, increased business at the Port and the need for good communication between pilots and tug boat captains, real-time meteorological data, pilots can decline a job at any time based on safety, ships may stop moving at 35 knots due to wave height and pilot boarding, and the positive aspects of Port Manatee.

Terry Fluke, Executive Director, Tampa Bay Pilots Association, stated the channel tightens as it moves further north into Tampa Bay. He used a slide presentation to provide a history of the Pilots Association established in 1886 on Egmont Key, the channel, weather conditions, leveraging technology to navigate the channel with (Portable Pilot Units) PPU devices, increased business at the Port and the need for good communication between pilots and tug boat captains, real-time meteorological data, pilots can decline a job at any time based on safety, ships may stop moving at 35 knots due to wave height and pilot boarding, and the positive aspects of Port Manatee.

![]() Mr. Buqueras responded that line handling is performed by Port staff.

Mr. Buqueras responded that line handling is performed by Port staff.

![]() Mr. Fluke continued the slides to address the pilot workforce, maritime information and vessel schedules (harbor master duties) are provided for Tampa Bay, and community support.

Mr. Fluke continued the slides to address the pilot workforce, maritime information and vessel schedules (harbor master duties) are provided for Tampa Bay, and community support.

Discussion ensued that ship scheduling requires a two and half hour notice (prefer 36 hours), foreign vessels require 96 hour notice from the Coast Guard, once notice is received, the ship is put on the schedule (first come/first serve), there is no different protocol for petroleum except during a hurricane when petroleum is needed, the Coast Guard has jurisdiction to close the Port and instruct vessels to leave the berths, if a port closes there will be vessels waiting to enter, ships can ride out the storm, pilots manage traffic, shoehorning ships into berths is common, since ships are getting bigger and port infrastructure has remained the same, there are plans to expand berths at Port Manatee, the Coast Guard provides bulletins regarding storm activity, there are no bailouts in Tampa Bay, and technology has improved significantly since the Skyway incident.

![]() Mr. Buqueras stated Berth 4 expansion is planned for an additional berth to the south. The Port remains open during storms for any transport company that wants to pick up cargo for land-side transport. PA20210728DOC004

Mr. Buqueras stated Berth 4 expansion is planned for an additional berth to the south. The Port remains open during storms for any transport company that wants to pick up cargo for land-side transport. PA20210728DOC004

CONSENT AGENDA PA20210728DOC005

4. ![]() A motion was made by Member Servia seconded by Member Whitmore, and carried 5-2, with Members Baugh and Satcher voting nay, to approve the Consent Agenda incorporating the language as stated in the recommended motions on the cover sheets for the Consent Agenda, with the deletion of item D, Travel and Proprietary Activities Policy. PA20210728DOC006

A motion was made by Member Servia seconded by Member Whitmore, and carried 5-2, with Members Baugh and Satcher voting nay, to approve the Consent Agenda incorporating the language as stated in the recommended motions on the cover sheets for the Consent Agenda, with the deletion of item D, Travel and Proprietary Activities Policy. PA20210728DOC006

WARRANT LIST

Accepted Warrant Listing from May 13, 2021, to July 18, 2021 PA20210728DOC007

MINUTES

Approved the Minutes May 20, 2021

BUDGET AMENDMENT

Adopted Budget Resolution PA-21-11 PA20210728DOC008

LOBBYING SERVICES

Executed Contract for Professional Services between the Manatee County Port Authority and Jocelyn Hong and Associates LLC PA20210728DOC009

WORLD DIRECT SHIPPINIG AND CARGO FREIGHT VOLUME

Executed the World Direct Shipping Cargo and Freight Volume Agreement Amendment Four between the Manatee County Port Authority and World Direct Shipping PA20210728DOC010

TAMPA BAY ESTUARY PROGRAM

Executed the Amended and Restated Interlocal Agreement Between the Tampa Bay Estuary Program and the Manatee County Port Authority. PA20210728DOC011

(End Consent Agenda)

![]() Discussion ensued that pulling an item from the Consent is common, and the Clerk and Port Councel will address the travel policy, it is common for the Chairman to discuss items that are going before the Authority, Chairman Bellamy requested a meeting with the Clerk regarding the travel policy, if an item is on the agenda, there should be discussion at the meeting.

Discussion ensued that pulling an item from the Consent is common, and the Clerk and Port Councel will address the travel policy, it is common for the Chairman to discuss items that are going before the Authority, Chairman Bellamy requested a meeting with the Clerk regarding the travel policy, if an item is on the agenda, there should be discussion at the meeting.

![]() Chairman Bellamy stated the item will be discussed at the next Port Authority meeting, and he was under the assumption that the item would not be on the agenda, but the agenda was already posted.

Chairman Bellamy stated the item will be discussed at the next Port Authority meeting, and he was under the assumption that the item would not be on the agenda, but the agenda was already posted.

![]() Discussion ensued that policy changes are brought forward to the Board, this item has yet to be voted on, and the Port Authority is the only one to set policy.

Discussion ensued that policy changes are brought forward to the Board, this item has yet to be voted on, and the Port Authority is the only one to set policy.

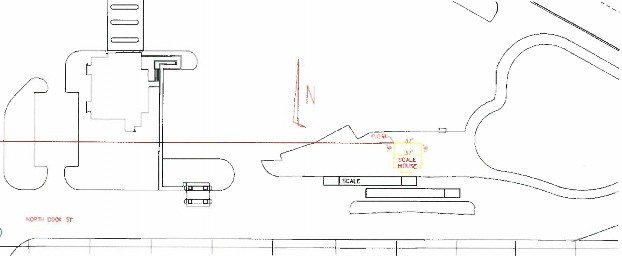

SOUTH GATE EXPANSION

Mr. Buqueras stated the expansion will allow more trucks to enter the Port.

Mr. Buqueras stated the expansion will allow more trucks to enter the Port.A motion was made by Member Servia and seconded by Member Whitmore to execute the Design Build Contract between Ajax Paving Industries and the Manatee County Port Authority which includes a fee of $148,297 for Phase 1 Services of the South Gate Expansion Project.

The motion carried 7-0. PA20210728DOC012

FINANCE DIRECTOR

Angel Colonneso, Clerk of the Circuit Court introduced Kim Wilder as Finance Director.

EXECUTIVE DIRECTOR COMMENTS

Flowers are being delivered via ship from Mexico to Port Manatee

Manatee County Area Transit (MCAT) launched Port Manatee call-ahead bus service

Schedule container yard expansion

World Direct Shipping purchased 400 acres next to the Port for business expansion

Aceros Arequipa to export scrap metal from the Port

An alligator was relocated to a gator farm in Arcadia

Rebranding to “Seaport Manatee”

New Port Communications, Sunny Venable

Diego Arrospide, Aceros Arequipa, provided information on their operations and that they melt recycled steel. Metal is processed into separate elements and they only export the ferrous metal.

Diego Arrospide, Aceros Arequipa, provided information on their operations and that they melt recycled steel. Metal is processed into separate elements and they only export the ferrous metal.Member Comments

Member Kruse

Member KruseAppreciated being a the Port for the meeting

Interested to discuss the Travel Policy and perspective client anonymity

Member Baugh

Stressed the importance of anonymity when discussing potential business and the competitiveness of Port Tampa

Member Whitmore

Explained how the Port is a business and not a Government and suggested a creative way to keep potential customers confidential

Member Van Ostenbridge made a motion to reconsider the vote for the consent agenda. The motion was seconded by Member Baugh and carried 4-3 with Chairman Bellamy and Members Servia and Whitmore voting nay.

Jennifer Cowan, Port Authority Attorney explained what the new motion will be.

CONSENT AGENDA

A motion was made by Member Baugh, seconded by Member Kruse, and carried 6-1, with Members Servia voting nay, to approve the Consent Agenda incorporating the language as stated in the recommended motions on the cover sheets for the entire Consent Agenda including item D.

TRAVEL AND PROPRIETARY ACTIVITIES POLICIES

Approved the updated Chapter 6 Proprietary Activities and Chapter 10 Travel polices of the Manatee County Port Authority Policies PA20210728DOC006

Angel Colonneso, Clerk of the Circuit Court, stated she will have individual meetings with Port Authority Member. The Clerk is held accountable to voters, and there are higher government accounting standards. There are unique issues for Manatee County with the Board of County Commissioners also acting as the Port Authority.

Member Servia

Member Servia

MCAT ridership has not been as high as expected and the service is on-demand

MCAT ridership has not been as high as expected and the service is on-demandStressed the importance of collaboration and have a mindset to work together to succeed

Discussion ensued that the service will be provided for a year and reviewed, find out why people are not using the service, low ridership could be a loss of independence, provide additional marketing, and are tenants going out in the community to market jobs.

Mr. Buqueras explained the Port will be holding job fairs and marking will take place. Chairman Bellamy

Mr. Buqueras explained the Port will be holding job fairs and marking will take place. Chairman BellamyReferenced “Iron Sharpens Iron”, and noted a lot of information is gained by seeking knowledge and collaborating

ADJOURN

There being no further business, Chairman Bellamy adjourned the meeting at 10:50 pm

Minutes Approved:

August 19, 2021

CONSENT

AGENDA ITEM 2.C: BUDGET RESOLUTION BACKGROUND:

This resolution budgets the following:

$621,143 of Port cash to align the principal and interest payments with the Series 2021 Bonds debt service schedule.

$3,625,690 for the Florida Department of Transportation (FDOT) Public Transportation Grant Agreement (PTGA) for an increase to the Intermodal Container Yard project funded 50% FDOT in the amount of $1,812,845 and 50% Port cash of $1,812,845.

ATTACHMENT:

Budget Resolution PA-21-17.

COST AND FUNDING SOURCE:

Budgets $1,812,845 FDOT grant funding and $2,433,988 port cash.

CONSEQUENCES IF DEFERRED:

Delay in budget allocations.

LEGAL COUNSEL REVIEW: N/A RECOMMENDATION:

Move to adopt Budget Resolution PA-21-17.

RESOLUTION PA-21-17 AMENDING THE ANNUAL BUDGET

FOR MANATEE COUNTY PORT AUTHORITY FOR FISCAL YEAR 2020-2021

WHEREAS, Florida Statutes 129.06, authorizes the Manatee County Port Authority to amend its budget for the current fiscal year as follows:

Appropriations for expenditures in any fund may be decreased and other appropriations in the same fund correspondingly increased, provided the total appropriations of the fund are not changed.

Appropriations from reserves may be made to increase the appropriation for any particular expense in the same fund, or to create an appropriation in the fund for any lawful purpose.

Unanticipated revenues, including increased receipts for enterprise or propriety funds, may be appropriated for their intended purpose, and may be transferred between funds to properly account for the unanticipated revenue.

NOW, THEREFORE, BE IT RESOLVED by the Manatee County Port Authority that the 2020-2021 budget is hereby amended in accordance with Section 129.06, Florida Statutes as described on the attached summary and specified in the budget adjustment batch files which are listed below:

Item No.

Batch ID No.

Reference No.

1

BAAL081921A

BU21000447

2

BAAL081921A

BU21000448

ADOPTED with a quorum present and voting this the 19th day of August, 2021.

ATTEST: ANGELINA M. COLONNESO MANATEE COUNTY PORT AUTHORITY

CLERK OF CIRCUIT COURT

By:

BUDGET ADMENDMENT RESOLUTION NO. PA-21-17 AGENDA DATE: August 19, 2021

Fund: Port Debt Service Section: Debt Service

Description: Budgets $621,143 to align the 2021 Bonds debt service principal and interest schedules.

Batch ID: BAAL081921A Reference: BU21000447

Fund: FDOT – 50% Port Cash – 50%

Section: Intermodal Container Yard Expansion

Description: Budgets $3,625,690 for additional grant funding for the Intermodal Container Yard project.

Batch ID: BAAL081921A Reference: BU21000448

August 19, 2021

CONSENT

AGENDA ITEM 2.D: PUBLIC TRANSPORTATION GRANT

AGREEMENT –MASTER PLAN

BACKGROUND:

The Florida Department of Transportation (FDOT) has agreed to participation in the funding of $250,000 for the Master Plan Update and has provided the attached the Public Transportation Grant Agreement (PTGA). As a condition of the grant, the Port is obligated to contribute 50% (or $250,000), bringing the total project costs to $500,000. To enter into the agreement, FDOT requires that the Port Authority adopt a resolution specifically approving the PTGA and authorizing the execution of the PTGA on behalf of the Port Authority by specifically designated officials.

ATTACHMENT:

Resolution PA-21-13 and the State of Florida Department of Transportation Public Transportation Grant Agreement

COST AND FUNDING SOURCE:

FDOT funding of $250,000 and $250,000 Port

CONSEQUENCES IF DEFERRED:

Delay in execution of the PTGA

LEGAL COUNSEL REVIEW: Yes RECOMMENDATION:

Move to adopt Resolution PA-21-13 authorizing the execution of the Public Transportation Grant Agreement with the Florida Department of Transportation for the Master Plan Update.

Financial Project Number

435770-1-94-02

PA-21-13

A RESOLUTION BY THE MANATEE COUNTY PORT AUTHORITY APPROVING AND AUTHORIZING THE EXECUTION OF THE PUBLIC TRANSPORTATION GRANT AGREEMENT WITH THE FLORIDA DEPARTMENT OF TRANSPORTATION

WHEREAS, the State of Florida Department of Transportation (Department) has offered to enter into a Public Transportation Grant Agreement with the Manatee County Port Authority (Port Authority) to provide Department participation in the Master Plan Update, and

WHEREAS, the Port Authority has the authority to enter into said Public Transportation Grant Agreement with the Department, and it is expedient and in the best interests of this Port Authority to approve and authorize the execution of the Public Transportation Grant Agreement.

NOW THEREFORE BE IT RESOLVED by the Manatee County Port Authority

that:

The State of Florida Department of Transportation Public Transportation Grant Agreement, identified as Financial Project Number 435770-1-94-02 wherein the Department agrees to a maximum participation in the amount of $250,000 is approved. The Chairman of the Port Authority, or, in the absence of the Chairman, any Vice Chairman of the Port Authority, is authorized to execute the Public Transportation Agreement on behalf of the Port Authority.

The Clerk of the Circuit Court of Manatee County, Florida, is authorized to cause two copies of this resolution to be certified for delivery to the Florida Department of Transportation.

ADOPTED with a quorum present and voting this the 19th day of August, 2021. ATTEST: ANGELINA M. COLONNESO MANATEE COUNTY PORT

CLERK OF CIRCUIT COURT AUTHORITY

By:

Chairman

Financial Project Number(s):

(item-segment-phase-sequence)

Fund(s):

435770-1-94-02 Work Activity Code/Function:

Federal Number/Federal Award

POED FLAIR Category:

215 Object Code:

Org. Code:

Identification Number (FAIN) – Transit only: Vendor Number:

088807

751000

55012020129

VF596000727160

Contract Number: G1Z25 Federal Award Date:

CFDA Number:

CFDA Title: CSFA Number: CSFA Title:

N/A

Agency DUNS Number:

01-973-

7399

N/A

55.034

Seaport Investment Program

THIS PUBLIC TRANSPORTATION GRANT AGREEMENT (“Agreement”) is entered into

_ __ _, by and between the State of Florida, Department of Transportation, (“Department”), and Manatee County Port Authority, (“Agency”). The Department and the Agency are sometimes referred to in this Agreement as a “Party” and collectively as the “Parties.”

NOW, THEREFORE, in consideration of the mutual benefits to be derived from joint participation on the Project, the Parties agree to the following:

Authority. The Agency, by Resolution or other form of official authorization, a copy of which is attached as Exhibit “D”, Agency Resolution and made a part of this Agreement, has authorized its officers to execute this Agreement on its behalf. The Department has the authority pursuant to Section(s) 311, Florida Statutes, to enter into this Agreement.

Purpose of Agreement. The purpose of this Agreement is to provide for the Department’s participation in Port Manatee's planning initiative, as further described in Exhibit "A", Project Description and Responsibilities, attached and incorporated into this Agreement (“Project”), to provide Department financial assistance to the Agency, state the terms and conditions upon which Department funds will be provided, and to set forth the manner in which the Project will be undertaken and completed.

Program Area. For identification purposes only, this Agreement is implemented as part of the Department program area selected below (select all programs that apply):

Aviation

X Seaports Transit Intermodal

Rail Crossing Closure

Match to Direct Federal Funding (Aviation or Transit)

(Note: Section 15 and Exhibit G do not apply to federally matched funding)

Other

Exhibits. The following Exhibits are attached and incorporated into this Agreement:

X Exhibit A: Project Description and Responsibilities X Exhibit B: Schedule of Financial Assistance

*Exhibit B1: Deferred Reimbursement Financial Provisions

*Exhibit B2: Advance Payment Financial Provisions

*Exhibit C: Terms and Conditions of Construction X Exhibit D: Agency Resolution

X Exhibit E: Program Specific Terms and Conditions X Exhibit F: Contract Payment Requirements

X *Exhibit G: Audit Requirements for Awards of State Financial Assistance

*Exhibit H: Audit Requirements for Awards of Federal Financial Assistance

*Additional Exhibit(s):

*Indicates that the Exhibit is only attached and incorporated if applicable box is selected.

Time. Unless specified otherwise, all references to “days” within this Agreement refer to calendar days.

Term of Agreement. This Agreement shall commence upon full execution by both Parties (“Effective Date”) and continue through April 30, 2026. If the Agency does not complete the Project within this time period, this Agreement will expire unless an extension of the time period is requested by the Agency and granted in writing by the Department prior to the expiration of this Agreement. Expiration of this Agreement will be considered termination of the Project. The cost of any work performed prior to the Effective Date or after the expiration date of this Agreement will not be reimbursed by the Department.

If this box is checked the following provision applies:

Unless terminated earlier, work on the Project shall commence no later than the day of , or within days of the issuance of the Notice to Proceed for the construction phase of the Project (if the Project involves construction), whichever date is earlier. The Department shall have the option to immediately terminate this Agreement should the Agency fail to meet the above-required dates.

Amendments, Extensions, and Assignment. This Agreement may be amended or extended upon mutual written agreement of the Parties. This Agreement shall not be renewed. This Agreement shall not be assigned, transferred, or otherwise encumbered by the Agency under any circumstances without the prior written consent of the Department.

Termination or Suspension of Project. The Department may, by written notice to the Agency, suspend any or all of the Department’s obligations under this Agreement for the Agency’s failure to comply with applicable law or the terms of this Agreement until such time as the event or condition resulting in such suspension has ceased or been corrected.

Notwithstanding any other provision of this Agreement, if the Department intends to terminate the Agreement, the Department shall notify the Agency of such termination in writing at least thirty (30) days prior to the termination of the Agreement, with instructions to the effective date of termination or specify the stage of work at which the Agreement is to be terminated.

The Parties to this Agreement may terminate this Agreement when its continuation would not produce beneficial results commensurate with the further expenditure of funds. In this event, the Parties shall agree upon the termination conditions.

If the Agreement is terminated before performance is completed, the Agency shall be paid only for that work satisfactorily performed for which costs can be substantiated. Such payment, however, may not exceed the equivalent percentage of the Department’s maximum financial assistance. If any portion of the Project is located on the Department’s right-of-way, then all work in progress on the Department right-of-way will become the property of the Department and will be turned over promptly by the Agency.

In the event the Agency fails to perform or honor the requirements and provisions of this Agreement, the Agency shall promptly refund in full to the Department within thirty (30) days of the termination of the Agreement any funds that were determined by the Department to have been expended in violation of the Agreement.

The Department reserves the right to unilaterally cancel this Agreement for failure by the Agency to comply with the Public Records provisions of Chapter 119, Florida Statutes.

Project Cost:

The estimated total cost of the Project is $500,000. This amount is based upon Exhibit "B", Schedule of Financial Assistance. The timeline for deliverables and distribution of estimated amounts between deliverables within a grant phase, as outlined in Exhibit "B", Schedule of Financial Assistance, may be modified by mutual written agreement of the Parties and does not require execution of an Amendment to the Public Transportation Grant Agreement. The timeline for deliverables and distribution of estimated amounts between grant phases requires an amendment executed by both Parties in the same form as this Agreement.

The Department agrees to participate in the Project cost up to the maximum amount of

$250,000 and, the Department’s participation in the Project shall not exceed 50.00% of the total eligible cost of the Project, and as more fully described in Exhibit “B’’, Schedule of Financial Assistance. The Agency agrees to bear all expenses in excess of the amount of the Department’s participation and any cost overruns or deficits involved.

Compensation and Payment:

Eligible Cost. The Department shall reimburse the Agency for allowable costs incurred as described in Exhibit “A”, Project Description and Responsibilities, and as set forth in Exhibit “B”, Schedule of Financial Assistance.

Deliverables. The Agency shall provide quantifiable, measurable, and verifiable units of deliverables. Each deliverable must specify the required minimum level of service to be performed and the criteria for evaluating successful completion. The Project and the quantifiable, measurable, and verifiable units of deliverables are described more fully in Exhibit “A”, Project Description and Responsibilities. Modifications to the deliverables in Exhibit “A”, Project Description and Responsibilities requires a formal written amendment.

Invoicing. Invoices shall be submitted no more often than monthly by the Agency in detail sufficient for a proper pre-audit and post-audit, based on the quantifiable, measurable, and verifiable deliverables as established in Exhibit “A”, Project Description and Responsibilities. Deliverables and costs incurred must be received and approved by the Department prior to reimbursement. Requests for reimbursement by the Agency shall include an invoice, progress report, and supporting documentation for the deliverables being billed that are acceptable to the Department. The Agency shall use the format for the invoice and progress report that is approved by the Department.

Supporting Documentation. Supporting documentation must establish that the deliverables were received and accepted in writing by the Agency and must also establish that the required minimum standards or level of service to be performed based on the criteria for evaluating successful completion as specified in Exhibit “A”, Project Description and Responsibilities has been met. All costs invoiced shall be supported by properly executed payrolls, time records, invoices, contracts, or vouchers evidencing in proper detail the nature and propriety of charges as described in Exhibit “F”, Contract Payment Requirements.

Travel Expenses. The selected provision below is controlling regarding travel expenses: X Travel expenses are NOT eligible for reimbursement under this Agreement.

Travel expenses ARE eligible for reimbursement under this Agreement. Bills for travel expenses specifically authorized in this Agreement shall be submitted on the Department’s Contractor Travel Form No. 300-000-06 and will be paid in accordance with Section 112.061, Florida Statutes, and the most current version of the Department’s Disbursement Handbook for Employees and Managers.

Financial Consequences. Payment shall be made only after receipt and approval of deliverables and costs incurred unless advance payments are authorized by the Chief Financial Officer of the State of Florida under Chapters 215 and 216, Florida Statutes, or the Department’s Comptroller under Section 334.044(29), Florida Statutes. If the Department determines that the performance of the Agency is unsatisfactory, the Department shall notify the Agency of the deficiency to be corrected, which correction shall be made within a time- frame to be specified by the Department. The Agency shall, within thirty (30) days after notice from the Department, provide the Department with a corrective action plan describing how the Agency will address all issues of contract non-performance, unacceptable performance, failure to meet the minimum performance levels, deliverable deficiencies, or contract non- compliance. If the corrective action plan is unacceptable to the Department, the Agency will not be reimbursed. If the deficiency is subsequently resolved, the Agency may bill the Department for the amount that was previously not reimbursed during the next billing period. If the Agency is unable to resolve the deficiency, the funds shall be forfeited at the end of the Agreement’s term.

Invoice Processing. An Agency receiving financial assistance from the Department should be aware of the following time frames. Inspection or verification and approval of deliverables shall take no longer than 20 days from the Department’s receipt of the invoice. The Department has 20 days to deliver a request for payment (voucher) to the Department of Financial Services. The 20 days are measured from the latter of the date the invoice is received or the deliverables are received, inspected or verified, and approved.

If a payment is not available within 40 days, a separate interest penalty at a rate as established pursuant to Section 55.03(1), Florida Statutes, will be due and payable, in addition to the invoice amount, to the Agency. Interest penalties of less than one (1) dollar will not be enforced unless the Agency requests payment. Invoices that have to be returned to an Agency because of Agency preparation errors will result in a delay in the payment. The invoice payment requirements do not start until a properly completed invoice is provided to the Department.

A Vendor Ombudsman has been established within the Department of Financial Services. The duties of this individual include acting as an advocate for Agency who may be experiencing problems in obtaining timely payment(s) from a state agency. The Vendor Ombudsman may be contacted at (850) 413-5516.

Records Retention. The Agency shall maintain an accounting system or separate accounts to ensure funds and projects are tracked separately. Records of costs incurred under the terms of this Agreement shall be maintained and made available upon request to the Department at all times during the period of this Agreement and for five years after final payment is made. Copies of these records shall be furnished to the Department upon request. Records of costs incurred include the Agency's general accounting records and the Project records, together with supporting documents and records, of the Contractor and all subcontractors performing work on the Project, and all other records of the Contractor and subcontractors considered necessary by the Department for a proper audit of costs.

Progress Reports. Upon request, the Agency agrees to provide progress reports to the Department in the standard format used by the Department and at intervals established by the Department. The Department will be entitled at all times to be advised, at its request, as to the status of the Project and of details thereof.

Submission of Other Documents. The Agency shall submit to the Department such data, reports, records, contracts, and other documents relating to the Project as the Department may require as listed in Exhibit "E", Program Specific Terms and Conditions attached to and incorporated into this Agreement.

Offsets for Claims. If, after Project completion, any claim is made by the Department resulting from an audit or for work or services performed pursuant to this Agreement, the Department may offset such amount from payments due for work or services done under any agreement that it has with the Agency owing such amount if, upon written demand, payment of the amount is not made within 60 days to the Department. Offsetting any amount pursuant to this paragraph shall not be considered a breach of contract by the Department.

Final Invoice. The Agency must submit the final invoice on the Project to the Department within 120 days after the completion of the Project. Invoices submitted after the 120-day time period may not be paid.

Department’s Performance and Payment Contingent Upon Annual Appropriation by the Legislature. The Department’s performance and obligation to pay under this Agreement is contingent upon an annual appropriation by the Legislature. If the Department's funding for this Project is in multiple fiscal years, a notice of availability of funds from the Department’s project manager must be received prior to costs being incurred by the Agency. See Exhibit “B”, Schedule of Financial Assistance for funding levels by fiscal year. Project costs utilizing any fiscal year funds are not eligible for reimbursement if incurred prior to funds approval being received. The Department will notify the Agency, in writing, when funds are available.

Limits on Contracts Exceeding $25,000 and Term more than 1 Year. In the event this Agreement is in excess of $25,000 and has a term for a period of more than one year, the provisions of Section 339.135(6)(a), Florida Statutes, are hereby incorporated:

"The Department, during any fiscal year, shall not expend money, incur any liability, or enter into any contract which, by its terms, involves the expenditure of money in excess of the amounts budgeted as available for expenditure during such fiscal year. Any contract, verbal or written, made in violation of this subsection is null and void, and no money may be paid on such contract. The Department shall require a statement from the comptroller of the Department that funds are available prior to entering into any such contract or other binding commitment of funds. Nothing herein contained shall prevent the making of contracts for periods exceeding 1 year, but any contract so made shall be executory only for the value of the services to be rendered or agreed to be paid for in succeeding fiscal years; and this paragraph shall be incorporated verbatim in all contracts of the Department which are for an amount in excess of $25,000 and which have a term for a period of more than 1 year."

Agency Obligation to Refund Department. Any Project funds made available by the Department pursuant to this Agreement that are determined by the Department to have been expended by the Agency in violation of this Agreement or any other applicable law or regulation shall be promptly refunded in full to the Department. Acceptance by the Department of any documentation or certifications, mandatory or otherwise permitted, that the Agency files shall not constitute a waiver of the Department's rights as the funding agency to verify all information at a later date by audit or investigation.

Non-Eligible Costs. In determining the amount of the payment, the Department will exclude all Project costs incurred by the Agency prior to the execution of this Agreement, costs incurred after the expiration of the Agreement, costs that are not provided for in Exhibit “A”, Project Description and Responsibilities, and as set forth in Exhibit “B”, Schedule of Financial Assistance, costs agreed to be borne by the Agency or its contractors and subcontractors for not meeting the Project commencement and final invoice time lines, and costs attributable to goods or services received under a contract or other arrangement that has not been approved

in writing by the Department. Specific unallowable costs may be listed in Exhibit “A”, Project Description and Responsibilities.

General Requirements. The Agency shall complete the Project with all practical dispatch in a sound, economical, and efficient manner, and in accordance with the provisions in this Agreement and all applicable laws.

Necessary Permits Certification. The Agency shall certify to the Department that the Agency’s design consultant and/or construction contractor has secured the necessary permits.

Right-of-Way Certification. If the Project involves construction, then the Agency shall provide to the Department certification and a copy of appropriate documentation substantiating that all required right-of-way necessary for the Project has been obtained. Certification is required prior to authorization for advertisement for or solicitation of bids for construction of the Project, even if no right-of-way is required.

Notification Requirements When Performing Construction on Department’s Right-of- Way. In the event the cost of the Project is greater than $250,000.00, and the Project involves construction on the Department’s right-of-way, the Agency shall provide the Department with written notification of either its intent to:

Require the construction work of the Project that is on the Department’s right-of-way to be performed by a Department prequalified contractor, or

Construct the Project utilizing existing Agency employees, if the Agency can complete said Project within the time frame set forth in this Agreement.

If this box is checked, then the Agency is permitted to utilize its own forces and the following provision applies: Use of Agency Workforce. In the event the Agency proceeds with any phase of the Project utilizing its own forces, the Agency will only be reimbursed for direct costs (this excludes general overhead).

If this box is checked, then the Agency is permitted to utilize Indirect Costs: Reimbursement for Indirect Program Expenses (select one):

Agency has selected to seek reimbursement from the Department for actual indirect expenses (no rate).

Agency has selected to apply a de minimus rate of 10% to modified total direct costs. Note: The de minimus rate is available only to entities that have never had a negotiated indirect cost rate. When selected, the de minimus rate must be used consistently for all federal awards until such time the agency chooses to negotiate a rate. A cost policy statement and de minimis certification form must be submitted to the Department for review and approval.

Agency has selected to apply a state or federally approved indirect cost rate. A federally approved rate agreement or indirect cost allocation plan (ICAP) must be submitted annually.

Agency Compliance with Laws, Rules, and Regulations, Guidelines, and Standards. The Agency shall comply and require its contractors and subcontractors to comply with all terms and conditions of this Agreement and all federal, state, and local laws and regulations applicable to this Project.

Claims and Requests for Additional Work. The Agency shall have the sole responsibility for resolving claims and requests for additional work for the Project. The Agency will make

best efforts to obtain the Department’s input in its decisions. The Department is not obligated to reimburse for claims or requests for additional work.

Contracts of the Agency:

Approval of Third Party Contracts. The Department specifically reserves the right to review and approve any and all third party contracts with respect to the Project before the Agency executes or obligates itself in any manner requiring the disbursement of Department funds, including consultant and purchase of commodities contracts, or amendments thereto. If the Department chooses to review and approve third party contracts for this Project and the Agency fails to obtain such approval, that shall be sufficient cause for nonpayment by the Department. The Department specifically reserves unto itself the right to review the qualifications of any consultant or contractor and to approve or disapprove the employment of the same. If Federal Transit Administration (FTA) funds are used in the Project, the Department must exercise the right to third party contract review.

Procurement of Commodities or Contractual Services. It is understood and agreed by the Parties hereto that participation by the Department in a project with the Agency, where said project involves the purchase of commodities or contractual services where purchases or costs exceed the Threshold Amount for CATEGORY TWO per Section 287.017, Florida Statutes, is contingent on the Agency complying in full with the provisions of Section 287.057, Florida Statutes. The Agency’s Authorized Official shall certify to the Department that the Agency’s purchase of commodities or contractual services has been accomplished in compliance with Section 287.057, Florida Statutes. It shall be the sole responsibility of the Agency to ensure that any obligations made in accordance with this Section comply with the current threshold limits. Contracts, purchase orders, task orders, construction change orders, or any other agreement that would result in exceeding the current budget contained in Exhibit "B", Schedule of Financial Assistance, or that is not consistent with the Project description and scope of services contained in Exhibit "A", Project Description and Responsibilities must be approved by the Department prior to Agency execution. Failure to obtain such approval, and subsequent execution of an amendment to the Agreement if required, shall be sufficient cause for nonpayment by the Department, in accordance with this Agreement.

Consultants’ Competitive Negotiation Act. It is understood and agreed by the Parties to this Agreement that participation by the Department in a project with the Agency, where said project involves a consultant contract for professional services, is contingent on the Agency’s full compliance with provisions of Section 287.055, Florida Statutes, Consultants’ Competitive Negotiation Act. In all cases, the Agency’s Authorized Official shall certify to the Department that selection has been accomplished in compliance with the Consultants’ Competitive Negotiation Act.

Disadvantaged Business Enterprise (DBE) Policy and Obligation. It is the policy of the Department that DBEs, as defined in 49 C.F.R. Part 26, as amended, shall have the opportunity to participate in the performance of contracts financed in whole or in part with Department funds under this Agreement. The DBE requirements of applicable federal and state laws and regulations apply to this Agreement. The Agency and its contractors agree to ensure that DBEs have the opportunity to participate in the performance of this Agreement. In this regard, all recipients and contractors shall take all necessary and reasonable steps in accordance with applicable federal and state laws and regulations to ensure that the DBEs have the opportunity to compete for and perform contracts. The Agency and its contractors and subcontractors shall not discriminate on the basis of race, color, national origin or sex in the award and performance of contracts, entered pursuant to this Agreement.

Maintenance Obligations. In the event the Project includes construction or the acquisition of commodities then the following provisions are incorporated into this Agreement:

The Agency agrees to accept all future maintenance and other attendant costs occurring after completion of the Project for all improvements constructed or commodities acquired as part of the Project. The terms of this provision shall survive the termination of this Agreement.

Sale, Transfer, or Disposal of Department-funded Property:

The Agency will not sell or otherwise transfer or dispose of any part of its title or other interests in real property, facilities, or equipment funded in any part by the Department under this Agreement without prior written approval by the Department.

If a sale, transfer, or disposal by the Agency of all or a portion of Department-funded real property, facilities, or equipment is approved by the Department, the following provisions will apply:

The Agency shall reimburse the Department a proportional amount of the proceeds of the sale of any Department-funded property.

The proportional amount shall be determined on the basis of the ratio of the Department funding of the development or acquisition of the property multiplied against the sale amount, and shall be remitted to the Department within ninety (90) days of closing of sale.

Sale of property developed or acquired with Department funds shall be at market value as determined by appraisal or public bidding process, and the contract and process for sale must be approved in advance by the Department.

If any portion of the proceeds from the sale to the Agency are non-cash considerations, reimbursement to the Department shall include a proportional amount based on the value of the non-cash considerations.

The terms of provisions “a” and “b” above shall survive the termination of this Agreement.

The terms shall remain in full force and effect throughout the useful life of facilities developed, equipment acquired, or Project items installed within a facility, but shall not exceed twenty (20) years from the effective date of this Agreement.

There shall be no limit on the duration of the terms with respect to real property acquired with Department funds.

Single Audit. The administration of Federal or State resources awarded through the Department to the Agency by this Agreement may be subject to audits and/or monitoring by the Department. The following requirements do not limit the authority of the Department to conduct or arrange for the conduct of additional audits or evaluations of Federal awards or State financial assistance or limit the authority of any state agency inspector general, the State of Florida Auditor General, or any other state official. The Agency shall comply with all audit and audit reporting requirements as specified below.

Federal Funded:

In addition to reviews of audits conducted in accordance with 2 CFR Part 200, Subpart F – Audit Requirements, monitoring procedures may include but not be limited to on-site visits by Department staff and/or other procedures, including reviewing any required performance and financial reports, following up, ensuring corrective action, and issuing management decisions on weaknesses found through audits when those findings pertain to Federal awards provided through the Department by this Agreement. By entering into this Agreement, the Agency agrees to comply and cooperate fully with any monitoring procedures/processes deemed appropriate by the Department. The Agency further agrees to comply and cooperate with any

inspections, reviews, investigations, or audits deemed necessary by the Department, State of Florida Chief Financial Officer (CFO), or State of Florida Auditor General.

The Agency, a non-Federal entity as defined by 2 CFR Part 200, Subpart F – Audit Requirements, as a subrecipient of a Federal award awarded by the Department through this Agreement, is subject to the following requirements:

In the event the Agency expends a total amount of Federal awards equal to or in excess of the threshold established by 2 CFR Part 200, Subpart F – Audit Requirements, the Agency must have a Federal single or program-specific audit conducted for such fiscal year in accordance with the provisions of 2 CFR Part 200, Subpart F – Audit Requirements. Exhibit “H”, Audit Requirements for Awards of Federal Financial Assistance, to this Agreement provides the required Federal award identification information needed by the Agency to further comply with the requirements of 2 CFR Part 200, Subpart F – Audit Requirements. In determining Federal awards expended in a fiscal year, the Agency must consider all sources of Federal awards based on when the activity related to the Federal award occurs, including the Federal award provided through the Department by this Agreement. The determination of amounts of Federal awards expended should be in accordance with the guidelines established by 2 CFR Part 200, Subpart F – Audit Requirements. An audit conducted by the State of Florida Auditor General in accordance with the provisions of 2 CFR Part 200, Subpart F – Audit Requirements, will meet the requirements of this part.

In connection with the audit requirements, the Agency shall fulfill the requirements relative to the auditee responsibilities as provided in 2 CFR Part 200, Subpart F – Audit Requirements.

In the event the Agency expends less than the threshold established by 2 CFR Part 200, Subpart F – Audit Requirements, in Federal awards, the Agency is exempt from Federal audit requirements for that fiscal year. However, the Agency must provide a single audit exemption statement to the Department at FDOTSingleAudit@dot.state.fl.us no later than nine months after the end of the Agency’s audit period for each applicable audit year. In the event the Agency expends less than the threshold established by 2 CFR Part 200, Subpart F – Audit Requirements, in Federal awards in a fiscal year and elects to have an audit conducted in accordance with the provisions of 2 CFR Part 200, Subpart F – Audit Requirements, the cost of the audit must be paid from non-Federal resources (i.e., the cost of such an audit must be paid from the Agency’s resources obtained from other than Federal entities).

The Agency must electronically submit to the Federal Audit Clearinghouse (FAC) at https://harvester.census.gov/facweb/ the audit reporting package as required by 2 CFR Part 200, Subpart F – Audit Requirements, within the earlier of 30 calendar days after receipt of the auditor’s report(s) or nine months after the end of the audit period. The FAC is the repository of record for audits required by 2 CFR Part 200, Subpart F

– Audit Requirements. However, the Department requires a copy of the audit reporting package also be submitted to FDOTSingleAudit@dot.state.fl.us within the earlier of 30 calendar days after receipt of the auditor’s report(s) or nine months after the end of the audit period as required by 2 CFR Part 200, Subpart F – Audit Requirements.

Within six months of acceptance of the audit report by the FAC, the Department will review the Agency’s audit reporting package, including corrective action plans and management letters, to the extent necessary to determine whether timely and appropriate action on all deficiencies has been taken pertaining to the Federal award provided through the Department by this Agreement. If the Agency fails to have an

audit conducted in accordance with 2 CFR Part 200, Subpart F – Audit Requirements, the Department may impose additional conditions to remedy noncompliance. If the Department determines that noncompliance cannot be remedied by imposing additional conditions, the Department may take appropriate actions to enforce compliance, which actions may include but not be limited to the following:

Temporarily withhold cash payments pending correction of the deficiency by the Agency or more severe enforcement action by the Department;

Disallow (deny both use of funds and any applicable matching credit for) all or part of the cost of the activity or action not in compliance;

Wholly or partly suspend or terminate the Federal award;

Initiate suspension or debarment proceedings as authorized under 2 C.F.R. Part 180 and Federal awarding agency regulations (or in the case of the Department, recommend such a proceeding be initiated by the Federal awarding agency);

Withhold further Federal awards for the Project or program;

Take other remedies that may be legally available.

As a condition of receiving this Federal award, the Agency shall permit the Department or its designee, the CFO, or State of Florida Auditor General access to the Agency’s records, including financial statements, the independent auditor’s working papers, and project records as necessary. Records related to unresolved audit findings, appeals, or litigation shall be retained until the action is complete or the dispute is resolved.

The Department’s contact information for requirements under this part is as follows: Office of Comptroller, MS 24

605 Suwannee Street

Tallahassee, Florida 32399-0450 FDOTSingleAudit@dot.state.fl.us

State Funded:

In addition to reviews of audits conducted in accordance with Section 215.97, Florida Statutes, monitoring procedures to monitor the Agency’s use of state financial assistance may include but not be limited to on-site visits by Department staff and/or other procedures, including reviewing any required performance and financial reports, following up, ensuring corrective action, and issuing management decisions on weaknesses found through audits when those findings pertain to state financial assistance awarded through the Department by this Agreement. By entering into this Agreement, the Agency agrees to comply and cooperate fully with any monitoring procedures/processes deemed appropriate by the Department. The Agency further agrees to comply and cooperate with any inspections, reviews, investigations, or audits deemed necessary by the Department, the Department of Financial Services (DFS), or State of Florida Auditor General.

The Agency, a “nonstate entity” as defined by Section 215.97, Florida Statutes, as a recipient of state financial assistance awarded by the Department through this Agreement, is subject to the following requirements:

In the event the Agency meets the audit threshold requirements established by Section 215.97, Florida Statutes, the Agency must have a State single or project- specific audit conducted for such fiscal year in accordance with Section 215.97, Florida Statutes; applicable rules of the Department of Financial Services; and Chapters 10.550 (local governmental entities) or 10.650 (nonprofit and for-profit organizations), Rules of the Auditor General. Exhibit “G”, Audit Requirements for Awards of State Financial Assistance, to this Agreement indicates state financial

assistance awarded through the Department by this Agreement needed by the Agency to further comply with the requirements of Section 215.97, Florida Statutes. In determining the state financial assistance expended in a fiscal year, the Agency shall consider all sources of state financial assistance, including state financial assistance received from the Department by this Agreement, other state agencies, and other nonstate entities. State financial assistance does not include Federal direct or pass-through awards and resources received by a nonstate entity for Federal program matching requirements.

In connection with the audit requirements, the Agency shall ensure that the audit complies with the requirements of Section 215.97(8), Florida Statutes. This includes submission of a financial reporting package as defined by Section 215.97(2)(e), Florida Statutes, and Chapters 10.550 (local governmental entities) or 10.650 (nonprofit and for-profit organizations), Rules of the Auditor General.

In the event the Agency does not meet the audit threshold requirements established by Section 215.97, Florida Statutes, the Agency is exempt for such fiscal year from the state single audit requirements of Section 215.97, Florida Statutes. However, the Agency must provide a single audit exemption statement to the Department at FDOTSingleAudit@dot.state.fl.us no later than nine months after the end of the Agency’s audit period for each applicable audit year. In the event the Agency does not meet the audit threshold requirements established by Section 215.97, Florida Statutes, in a fiscal year and elects to have an audit conducted in accordance with the provisions of Section 215.97, Florida Statutes, the cost of the audit must be paid from the Agency’s resources (i.e., the cost of such an audit must be paid from the Agency’s resources obtained from other than State entities).

In accordance with Chapters 10.550 (local governmental entities) or 10.650 (nonprofit and for-profit organizations), Rules of the Auditor General, copies of financial reporting packages required by this Agreement shall be submitted to:

Florida Department of Transportation Office of Comptroller, MS 24

605 Suwannee Street

Tallahassee, Florida 32399-0405 FDOTSingleAudit@dot.state.fl.us

And

State of Florida Auditor General Local Government Audits/342

111 West Madison Street, Room 401

Tallahassee, FL 32399-1450

Email: flaudgen_localgovt@aud.state.fl.us

Any copies of financial reporting packages, reports, or other information required to be submitted to the Department shall be submitted timely in accordance with Section 215.97, Florida Statutes, and Chapters 10.550 (local governmental entities) or 10.650 (nonprofit and for-profit organizations), Rules of the Auditor General, as applicable.

The Agency, when submitting financial reporting packages to the Department for audits done in accordance with Chapters 10.550 (local governmental entities) or 10.650 (nonprofit and for-profit organizations), Rules of the Auditor General, should indicate the date the reporting package was delivered to the Agency in correspondence accompanying the reporting package.

Upon receipt, and within six months, the Department will review the Agency’s financial reporting package, including corrective action plans and management letters, to the extent necessary to determine whether timely and appropriate corrective action on all deficiencies has been taken pertaining to the state financial assistance provided through the Department by this Agreement. If the Agency fails to have an audit conducted consistent with Section 215.97, Florida Statutes, the Department may take appropriate corrective action to enforce compliance.

As a condition of receiving state financial assistance, the Agency shall permit the Department or its designee, DFS, or the Auditor General access to the Agency’s records, including financial statements, the independent auditor’s working papers, and project records as necessary. Records related to unresolved audit findings, appeals, or litigation shall be retained until the action is complete or the dispute is resolved.

The Agency shall retain sufficient records demonstrating its compliance with the terms of this Agreement for a period of five years from the date the audit report is issued and shall allow the Department or its designee, DFS, or State of Florida Auditor General access to such records upon request. The Agency shall ensure that the audit working papers are made available to the Department or its designee, DFS, or State of Florida Auditor General upon request for a period of five years from the date the audit report is issued, unless extended in writing by the Department.

Notices and Approvals. Notices and approvals referenced in this Agreement must be obtained in writing from the Parties’ respective Administrators or their designees.

Restrictions, Prohibitions, Controls and Labor Provisions:

Convicted Vendor List. A person or affiliate who has been placed on the convicted vendor list following a conviction for a public entity crime may not submit a bid on a contract to provide any goods or services to a public entity; may not submit a bid on a contract with a public entity for the construction or repair of a public building or public work; may not submit bids on leases of real property to a public entity; may not be awarded or perform work as a contractor, supplier, subcontractor, or consultant under a contract with any public entity; and may not transact business with any public entity in excess of the threshold amount provided in Section 287.017, Florida Statutes, for CATEGORY TWO for a period of 36 months from the date of being placed on the convicted vendor list.

Discriminatory Vendor List. In accordance with Section 287.134, Florida Statutes, an entity or affiliate who has been placed on the Discriminatory Vendor List, kept by the Florida Department of Management Services, may not submit a bid on a contract to provide goods or services to a public entity; may not submit a bid on a contract with a public entity for the construction or repair of a public building or public work; may not submit bids on leases of real property to a public entity; may not be awarded or perform work as a contractor, supplier, subcontractor, or consultant under a contract with any public entity; and may not transact business with any public entity.

Non-Responsible Contractors. An entity or affiliate who has had its Certificate of Qualification suspended, revoked, denied, or have further been determined by the Department to be a non-responsible contractor, may not submit a bid or perform work for the construction or repair of a public building or public work on a contract with the Agency.

Prohibition on Using Funds for Lobbying. No funds received pursuant to this Agreement may be expended for lobbying the Florida Legislature, judicial branch, or any state agency, in accordance with Section 216.347, Florida Statutes.

Unauthorized Aliens. The Department shall consider the employment by any contractor of unauthorized aliens a violation of Section 274A(e) of the Immigration and Nationality Act. If the contractor knowingly employs unauthorized aliens, such violation will be cause for unilateral cancellation of this Agreement.

Procurement of Construction Services. If the Project is procured pursuant to Chapter 255, Florida Statutes, for construction services and at the time of the competitive solicitation for the Project, 50 percent or more of the cost of the Project is to be paid from state-appropriated funds, then the Agency must comply with the requirements of Section 255.0991, Florida Statutes.

E-Verify. The Agency shall:

Utilize the U.S. Department of Homeland Security’s E-Verify system to verify the employment eligibility of all new employees hired by the Agency during the term of the contract; and

Expressly require any subcontractors performing work or providing services pursuant to the state contract to likewise utilize the U.S. Department of Homeland Security’s E- Verify system to verify the employment eligibility of all new employees hired by the subcontractor during the contract term.

Executive Order 20-44. Pursuant to Governor’s Executive Order 20-44, if the Agency is required by the Internal Revenue Code to file IRS Form 990 and is named in statute with which the Department must form a sole-source, public-private agreement; or through contract or other agreement with the State, annually receives 50% or more of its budget from the State or from a combination of State and Federal funds, Recipient shall submit an Annual Report to the Department, including the most recent IRS Form 990, detailing the total compensation for each member of the Agency executive leadership team. Total compensation shall include salary, bonuses, cashed-in leave, cash equivalents, severance pay, retirement benefits, deferred compensation, real-property gifts, and any other payout. The Agency shall inform the Department of any changes in total executive compensation during the period between the filing of Annual Reports within 60 days of any change taking effect. All compensation reports shall detail the percentage of executive leadership compensation received directly from all State and/or Federal allocations to the Agency. Annual Reports shall be in the form approved by the Department and shall be submitted to the Department at fdotsingleaudit@dot.state.fl.us within 180 days following the end of each tax year of the Agency receiving Department funding.

Design Services and Construction Engineering and Inspection Services. If the Project is wholly or partially funded by the Department and administered by a local governmental entity, except for a seaport listed in Section 311.09, Florida Statutes, or an airport as defined in Section 332.004, Florida Statutes, the entity performing design and construction engineering and inspection services may not be the same entity.

Indemnification and Insurance:

It is specifically agreed between the Parties executing this Agreement that it is not intended by any of the provisions of any part of this Agreement to create in the public or any member thereof, a third party beneficiary under this Agreement, or to authorize anyone not a party to this Agreement to maintain a suit for personal injuries or property damage pursuant to the terms or provisions of this Agreement. The Agency guarantees the payment of all just claims

for materials, supplies, tools, or labor and other just claims against the Agency or any subcontractor, in connection with this Agreement. Additionally, the Agency shall indemnify and hold harmless the State of Florida, Department of Transportation, including the Department’s officers and employees, from liabilities, damages, losses, and costs, including, but not limited to, reasonable attorney’s fees, to the extent caused by the negligence, recklessness, or intentional wrongful misconduct of the Agency and persons employed or utilized by the Agency in the performance of this Agreement. This indemnification shall survive the termination of this Agreement. Additionally, the Agency agrees to include the following indemnification in all contracts with contractors/subcontractors and consultants/subconsultants who perform work in connection with this Agreement: